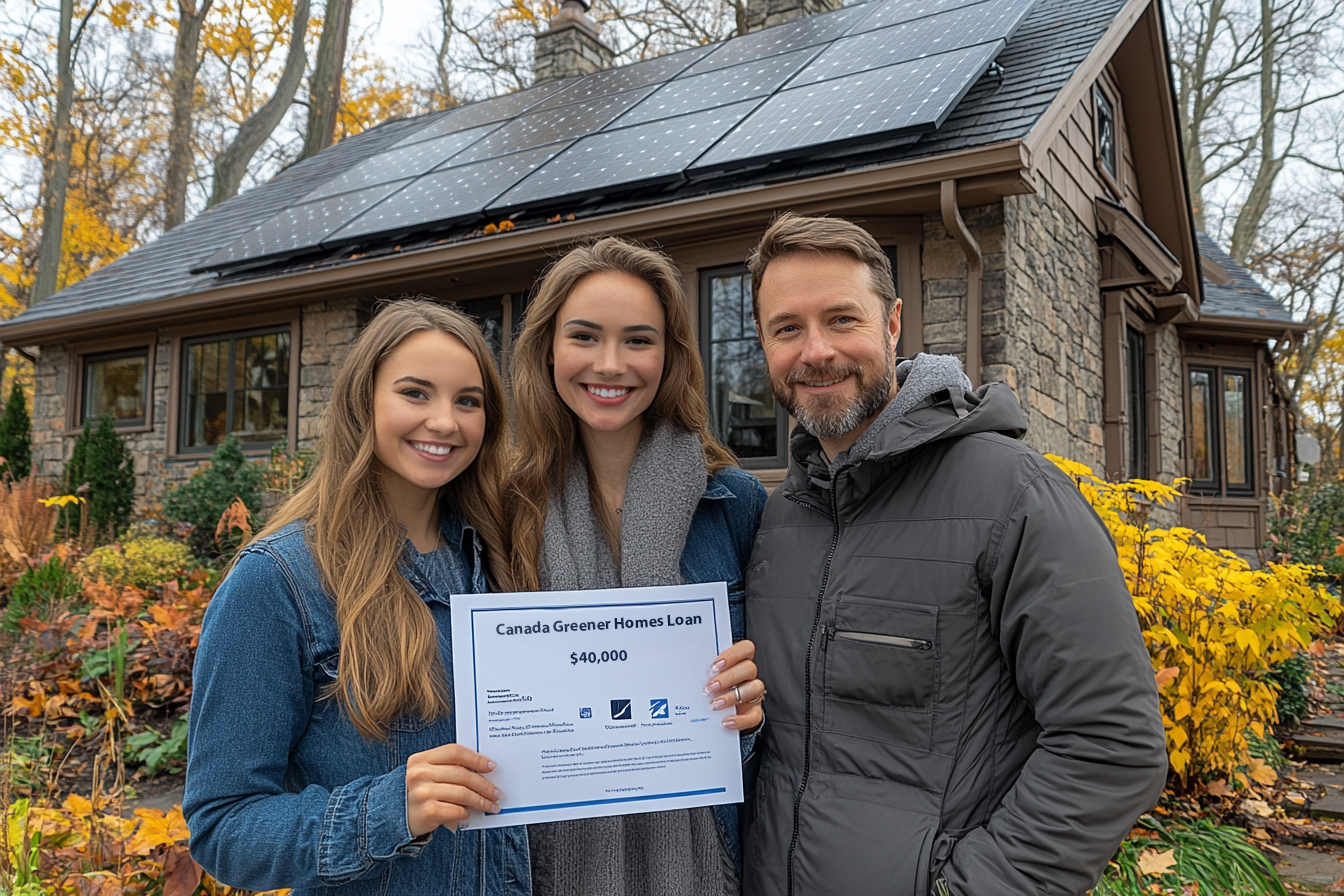

Canada Greener Homes Loan 2025: Complete Guide for Homeowners

Thinking about installing solar panels, a heat pump, or upgrading your home insulation, but worried about the upfront cost?

Enter the Canada Greener Homes Loan: a federal, interest-free financing program designed to help Canadians make energy-efficient home upgrades without financial strain.

This guide explains how the program works, who qualifies, what upgrades are covered, and how to combine it with grants and provincial rebates to maximize your savings.

What Is the Canada Greener Homes Loan?

The Canada Greener Homes Loan is a 0% interest loan designed to make energy efficiency upgrades accessible to Canadian homeowners.

| Feature | Details |

|---|---|

| Loan Amount | $5,000 to $40,000 |

| Interest Rate | 0% interest |

| Repayment Term | 10 years (fixed monthly payments) |

| Eligibility | Owner-occupied primary residences only |

| Deadline | Rolling applications, limited funding |

Note: This is a loan, not a grant—but the interest-free terms make it a powerful financial tool.

Read more: What Happened to the Canada Greener Homes Grant? Latest Update (2025)

What Upgrades Are Eligible for the Canada Greener Homes Loan?

The loan covers a wide range of energy-saving home improvements, including:

- Solar PV systems

- Heat pumps (air or ground source)

- High-efficiency insulation (attic, basement, wall)

- Energy-efficient windows and doors

- Air sealing

- Smart thermostats

- Battery storage systems

- Foundation insulation and waterproofing

Requirement: Upgrades must be recommended in your pre-retrofit EnerGuide evaluation by a registered energy advisor.

Example: A Calgary homeowner installs a 7 kW solar system and heat pump totaling $35,000.

→ Monthly payments: ~$292 over 10 years, interest-free

Who’s Eligible for the Canada Greener Homes Loan?

To qualify, you must:

- Own and live in the home as your primary residence

- Complete a pre-retrofit energy evaluation

- Complete at least one eligible upgrade

- Provide quotes and invoices from licensed contractors

- Complete a post-retrofit evaluation

Eligible Home Types:

- Detached homes

- Semi-detached and row houses

- Select low-rise MURBs (up to 3 storeys, 600 m² total)

Not Eligible:

- New construction

- Rental-only properties

- Condos with shared systems

How to Apply for the Canada Greener Homes Loan in 6 Easy Steps

- Register via the Greener Homes Loan portal

- Book a pre-retrofit audit with a certified energy advisor

- Review recommendations for eligible upgrades

- Get quotes and submit your loan application

- Complete upgrades using licensed contractors

- Book a post-retrofit audit and begin repayment

Tip: Start early—demand is high, and some areas have long waitlists for advisors.

Can I Combine Other Incentives with the Canada Greener Homes Loan?

Yes, and you should. Stacking programs with the Canada Greener Homes Loan can dramatically reduce your net cost.

| Program | Stackable? | Benefit |

|---|---|---|

| Clean Technology ITC (Federal) | ✅ | 30% tax credit on eligible costs |

| HER+ (Ontario) | ✅ | Up to $10,000 rebate from Enbridge |

| CleanBC | ✅ | Up to 100% rebate for low-income households |

| Efficiency Nova Scotia | ✅ | Rebates for heat pumps, solar, batteries |

| PEI Solar Rebate | ✅ | $1,000/kW up to $10,000 for solar |

| Efficiency Manitoba | ✅ | $500/kW up to $5,000 |

| Arctic Energy Alliance (NWT) | ✅ | 50% rebate up to $20,000 for solar |

| Nunavut REHIP | ✅ | 50% rebate up to $30,000 |

Example:

An Ontario homeowner installs a $30,000 solar + heat pump system

→ $5,000 rebate from Enbridge HER+

→ $9,000 tax credit (Clean Tech ITC)

→ Net cost = $16,000, financed interest-free over 10 years

What Happens if You Sell Your Home Before the Canada Greener Homes Loan Is Paid Off?

If you sell:

- You must repay the remaining balance in full

- The loan is not transferable to the new owner

- There’s no penalty for early repayment

Read more: Your Guide to Federal Clean Energy Incentives in Canada (2025)

Recommendation: Plan upgrades if you expect to remain in your home for at least 5–10 years to maximize energy savings and avoid early payback.

Conclusion

The Canada Greener Homes Loan is one of the most impactful clean energy financing programs in Canada. With up to $40,000 interest-free, it eliminates one of the biggest barriers to adopting:

- Solar

- Heat pumps

- Insulation and energy upgrades